south st paul mn sales tax rate

Future job growth over the next ten years is predicted to be 367 which is higher than the US average of 335. Property Tax Data and Statistics.

Property Taxes By State Embrace Higher Property Taxes

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

. 1912 W Atkinson Road Othello WA 99344. The Virginia sales tax rate is. 234 3rd Ave S South Saint Paul MN 55075-2311 is a single-family home listed for-sale at 262500.

Individual Income Tax Statistics. Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure. Paul - The Sales Tax Rate for South St.

This tax is in addition to the sales taxes collected by the State of Minnesota and Dakota County. South San Francisco CA. There is no applicable county tax.

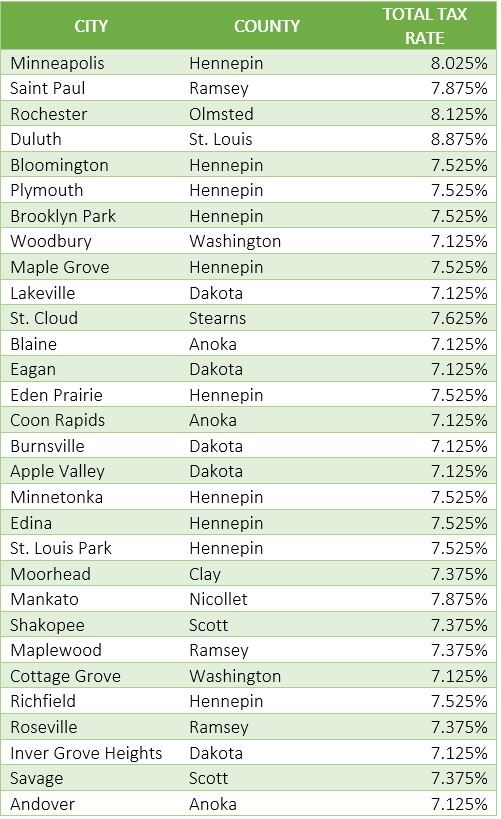

Paul Local Sales Tax will be collected through December 31 2040. Up to 890. Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

This is the total of state county and city sales tax rates. Individual Income Tax Statistics. This is the total of state county and city sales tax rates.

The December 2020 total local sales tax rate was also 7375. Town Square TV Council Meetings QuickLinksaspx. The US average is 73.

The Minnesota sales tax rate is currently. South Metro Fire Department. For tax rates in other cities see Minnesota sales taxes by city and county.

144 or 834 Employers with Experience Rating. The County sales tax rate is. The st paul park sales tax rate is 0.

View 2 photos of this 4966 sqft lot land located at Mn South Saint Paul MN 55075 on. 3 rows The 7125 sales tax rate in South Saint Paul consists of 6875 Minnesota state sales. River Heights Chamber of Commerce.

This 2019 PETERBILT 567 has 1 miles and is located in South Saint Paul Minnesota. Statistics and Annual. Corporate Income Tax Personal Income Tax Unemployment Compensation Sales.

Real property tax on median home. 9800 of gross income. 6875 Transit Improvement Tax.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Home is a 3 bed 10 bath property. 408 20th Ave S South Saint Paul MN 55075-2114 is a single-family home listed for-sale at 320000.

Paul has seen the job market increase by 18 over the last year. The Minnesota sales tax rate is currently. Sales Tax Rate Calculator.

Let us know in a single click. The County sales tax rate is. The 7875 sales tax rate in Saint Paul consists of 6875 Minnesota state sales tax 05 Saint Paul tax and 05 Special tax.

Tax Rates for South St. RETTER COMPANY SOTHEBYS INTERNATIONAL REALTY. The minimum combined 2022 sales tax rate for Virginia Minnesota is.

The South St Paul sales tax rate is. The results do not include special local taxessuch as admissions entertainment liquor lodging and restaurant taxesthat may also apply. The US average is 46.

Wayfair Inc affect Minnesota. Minnesota Historical Tax Rates. Minnesota Income Tax Statistics by County.

Sales and Corporate Tax Statistics. You can print a 7875 sales tax table here. Sales Tax State Local Sales Tax on Food.

Paul is 7625 percent. For more information on authorized local sales taxes also see the House Research publication Local Sales Taxes in Minnesota August 2010. Real property tax on median home.

5511 Hershey Ln West Richland WA 99353. Sales Tax State Local Sales Tax on Food. Learn all about South St.

Did South Dakota v. View more property details sales history and Zestimate data on Zillow. Contact legislative analyst Pat Dalton at 651-296-7434.

This is the total of state county and city sales tax rates. View more property details sales history and Zestimate data on Zillow. Whether you are already a resident or just considering moving to South St.

010 - 050 New Employers. Paul to live or invest in real estate estimate local property tax rates and learn how real estate tax works. There is no applicable county tax.

Home is a 3 bed 20 bath property. - Lot Land for sale. 50 40 50 6875 60 55 Sales Tax Rates as of July 2010.

Paul MN 55075 Phone. 1 day on Zillow. See reviews photos directions phone numbers and more for Sales Tax Rate locations in South Saint Paul MN.

- The Income Tax Rate for South St. The minimum combined 2022 sales tax rate for South St Paul Minnesota is. Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure.

Paul real estate tax. Percent while the rate in the city of St. For more information see Local Sales Tax Information.

Sales tax The charges for electric service resource adjustment.

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Nebraska Sales Tax Rates By City County 2022

Minnesota Sales Tax Rates By City County 2022

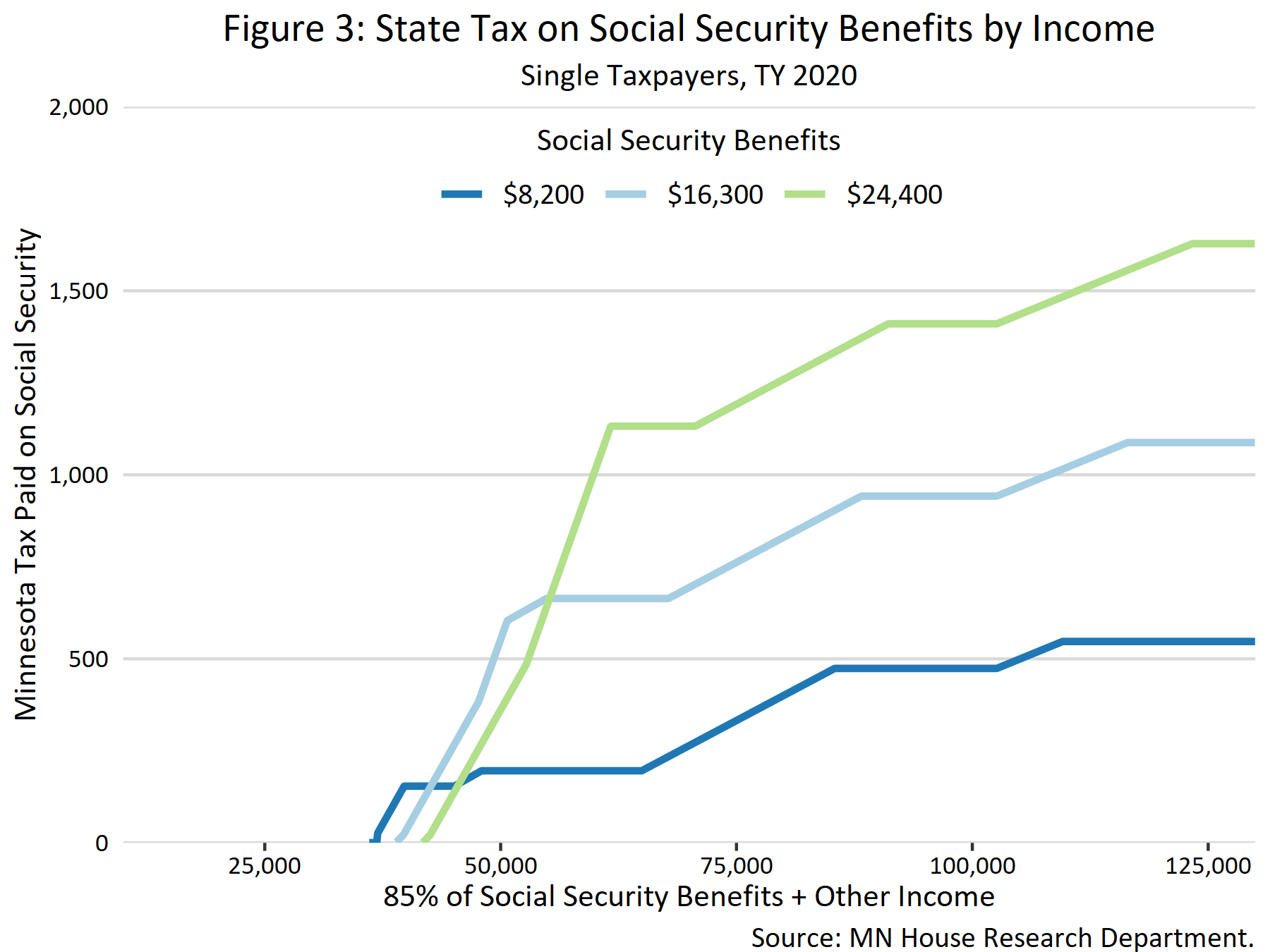

Taxation Of Social Security Benefits Mn House Research

Kansas Sales Tax Rates By City County 2022

Online Retail Sales Are Way Up So Are Local Sales Tax Collections In Minnesota Minnpost

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

State Income Tax Rates Highest Lowest 2021 Changes

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Tax Rate Calculator Minnesota Department Of Revenue

Arkansas Sales Tax Rates By City County 2022

Minnesota Sales And Use Tax Audit Guide